Backdrop: The market has been on a tare for 10 years. The big covid crash was very quickly forgotten. Anybody who owned big tech names got rich… Until about 4 months ago. The overall market is down like 15%, but some tech names have been obliterated. Lots of stocks are down, even some blue chips. When markets get expensive, the smart thing to do is save your cash and start researching the names you’ll want to buy when a selloff comes. I am not smart. I have just a tiny bit of cash, and I’ve sort of researched some names. Here’s a short list of companies I’m interested in:

- ADSK: Untouchable moat. Down 40% from ATH.

- BF.A: Down 20%. PE of 30. I want to own the booze stocks.

- DIS: Down 44%. Feels like a no-brainer. Hard for me to value.

- GOOGL: Down 20%. No-brainer, but do I want to own a $1.4 Trillion company?

- INTC: PE of 7. Investing Is Easy.

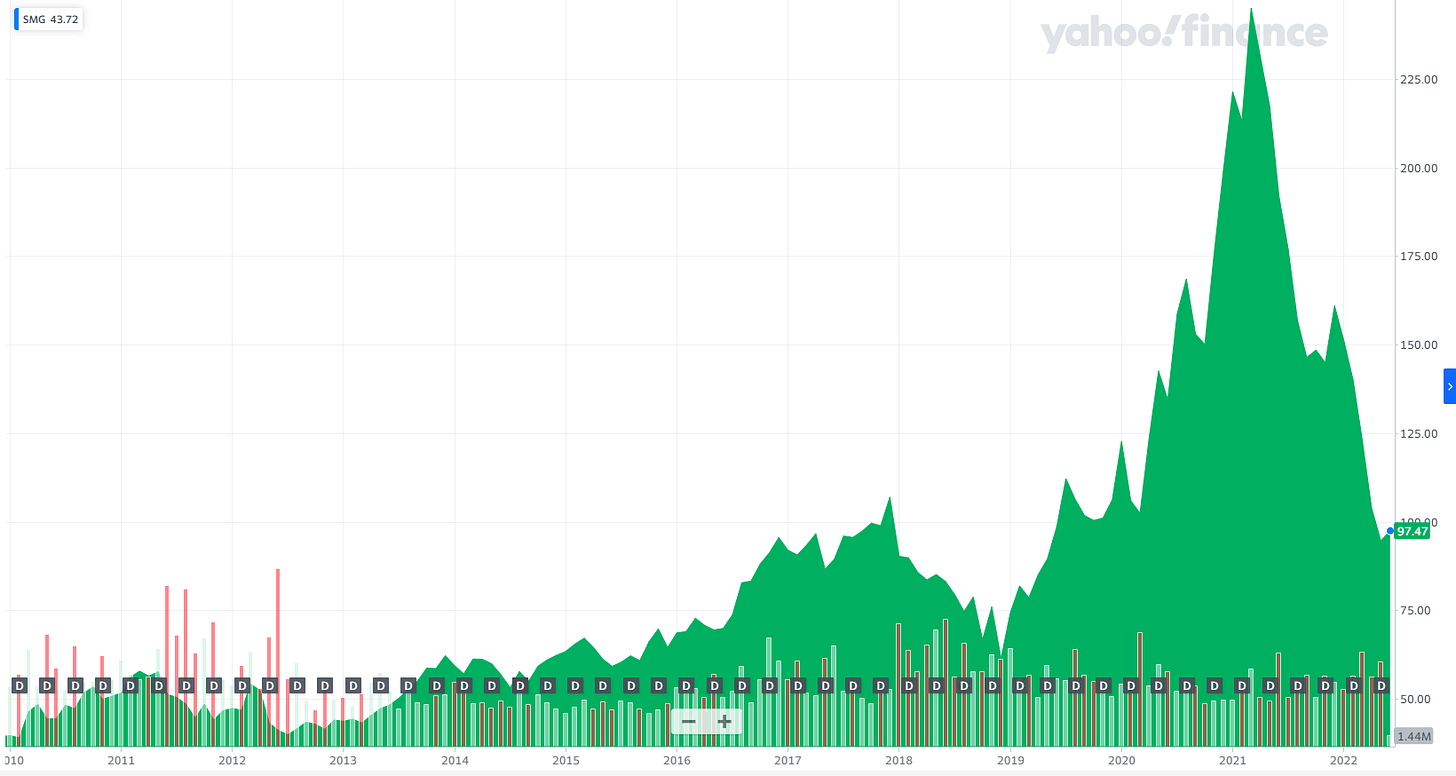

- SMG: Down 60% from 2021 highs. PE of 13. Dominates it’s category.

- TM: Down 20%. PE of 10, 4% dividend. I’m afraid of autos.

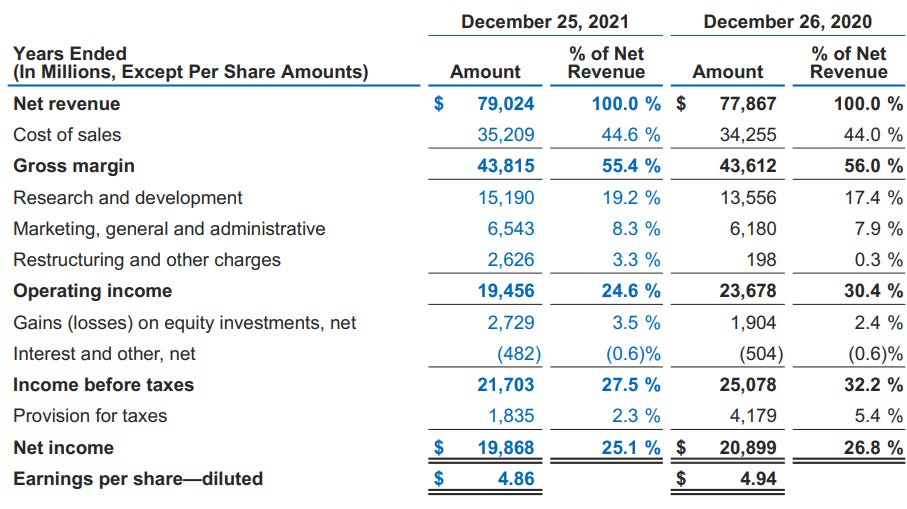

I’m pretty sure you could buy any/all of those stocks today, hold for 10 years, and be very happy. But I only have enough cash for one pick. The obvious choice would be Intel. I wrote it up in 2020 when it was $44/share. Since then, their financial performance has held steady.

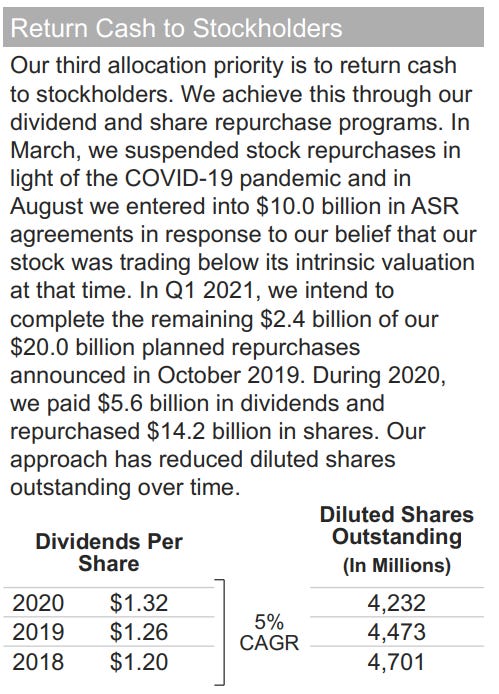

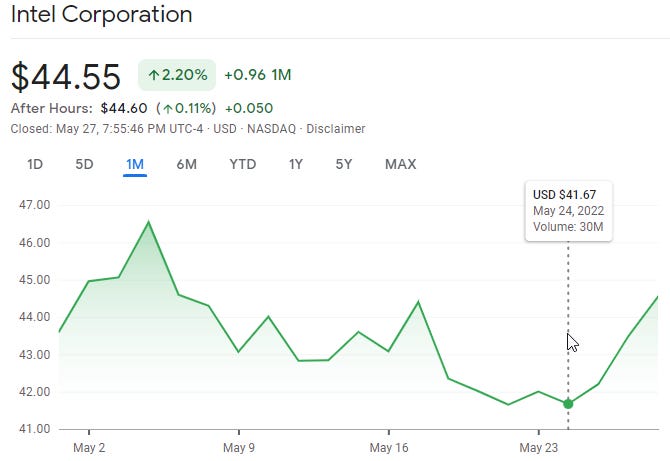

This should be a $70 stock. Who are these crazy people selling it for less than $50? In August 2020, the stock dropped from $60 to $48, and the company decided to accelerate their buyback program to the tune of $10 Billy. Well today it’s at $45. So now we know at least 2 things: These guys are not great market timers and this stock is cheap.

When I started this post, Intel was actually down at 41! So while I think it’s a no-brainer slam dunk, my immature anchor brain wants to wait to see 41 or lower again.

In the meantime, there is one other stock on my list that looks interesting:

Scotts Miracle-Gro is “the leading manufacturer and marketer of branded consumer lawn and garden products in North America”

“Scotts Miracle-Gro traces its heritage to a company founded by O.M. Scott in Marysville, Ohio in 1868… In fiscal 1995, through a merger with Stern’s Miracle-Gro Products, Inc., which was founded by Horace Hagedorn and Otto Stern in Long Island, New York in 1951, we acquired the Miracle-Gro® brand... In fiscal 1999, we acquired the Ortho® brand in the United States and obtained exclusive rights to market Monsanto’s consumer Roundup® brand within the United States…”

2021 AR https://scottsmiraclegro.gcs-web.com/static-files/23bfa654-67d3-4f38-bbca-245caa6a557d

SMG is a dominant brand in lawn and gardening. Since 1995, they have grown by acquisitions:

They own all the big brands:

https://scottsmiraclegro.com/who-we-are/brands/

Which they sell at Home Depot, Lowes and Walmart:

"Kmart Corporation and Home Depot represented approximately 14.4% and 13.1%, respectively, of the Company's sales in fiscal 1995 and 16.1% and 10.7%, respectively, of the Company's outstanding trade accounts receivable at September 30, 1995"

https://www.sec.gov/Archives/edgar/data/825542/0000896463-95-000153.txt

“Our three largest customers are Home Depot, Lowe’s and Walmart. Home Depot and Lowe’s are the only customers that individually represent more than 10% of reported consolidated net sales during any of the three most recent fiscal years.”

https://scottsmiraclegro.gcs-web.com/static-files/5e448106-cc17-4a18-b8e4-9d7fdeb2f9e4

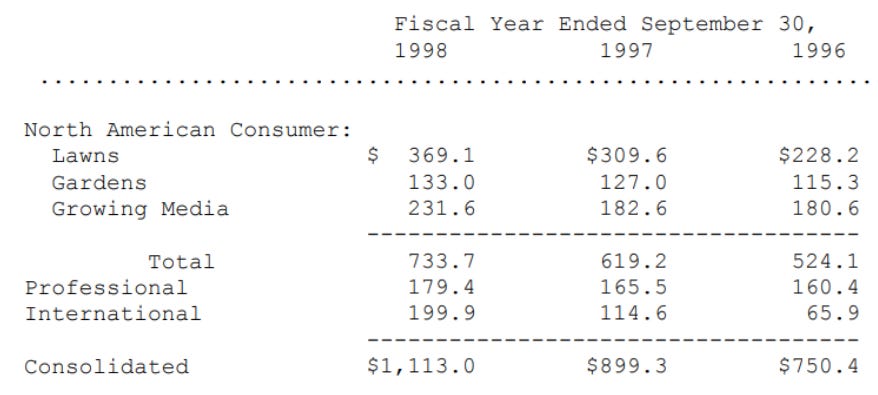

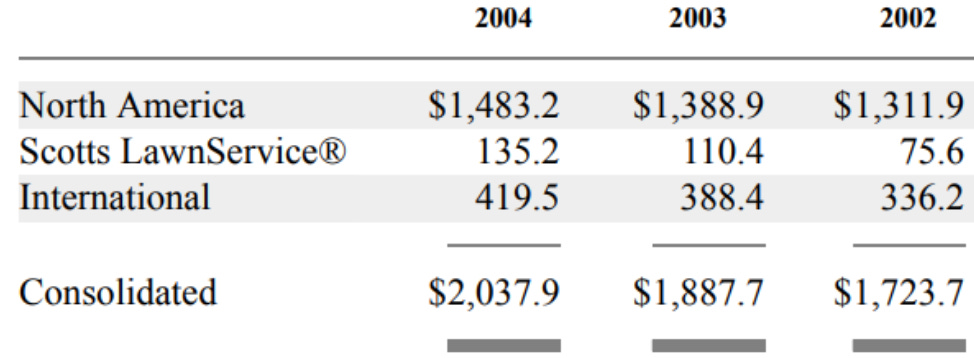

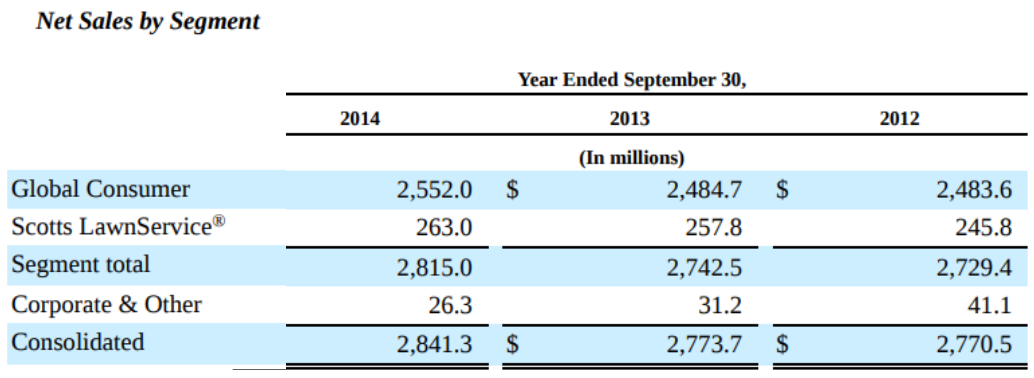

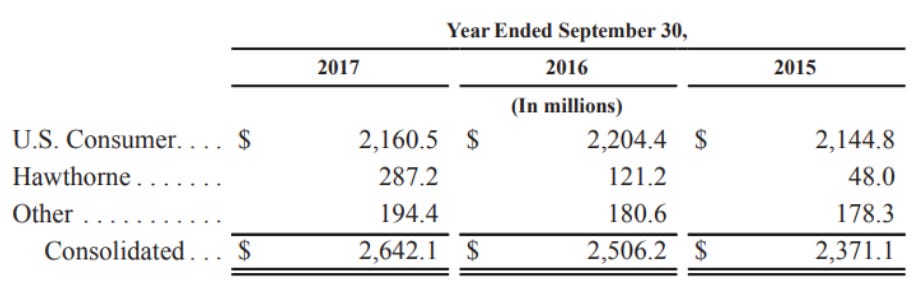

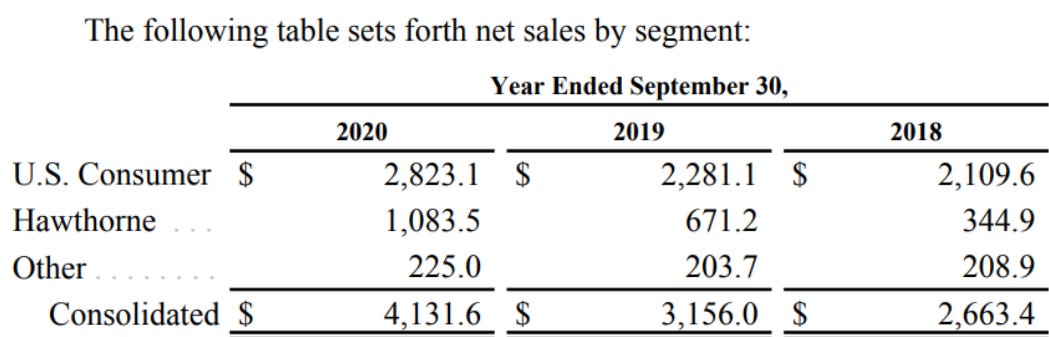

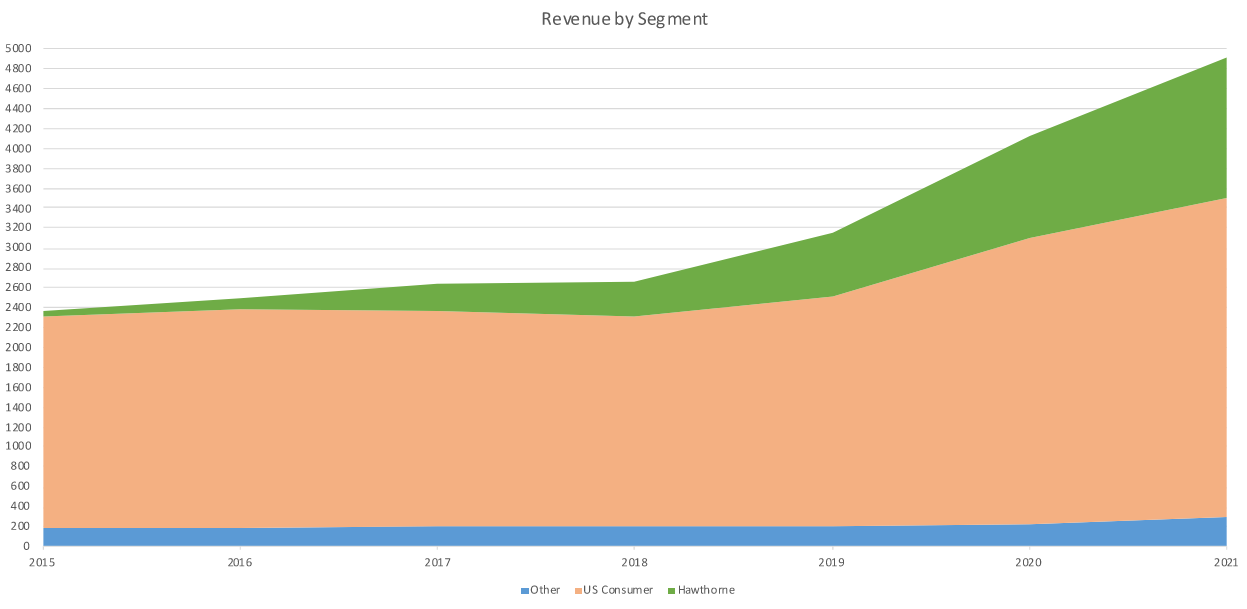

Their business segments have evolved and consolidated over time:

You can see they’ve dropped their international business and lawncare. The biggest part of this business has always been US consumer sales of lawn and garden products. But you can also see they launched Hawthorne in 2014.

In fiscal 2014, we advanced a number of key initiatives… as well as expansion into the urban and indoor consumer category through investments in AeroGrow and our newly formed subsidiary The Hawthorne Gardening Company (“Hawthorne”).

https://scottsmiraclegro.gcs-web.com/static-files/045f49a9-bbff-453c-84f9-4b13d586d34b

Urban and Indoor Consumer?? HUH?

Through our Hawthorne segment, we are the leading manufacturer, marketer and distributor of lighting, nutrients, growing media, growing environments and hardware products for indoor and hydroponic gardening in North America.

https://scottsmiraclegro.gcs-web.com/static-files/23bfa654-67d3-4f38-bbca-245caa6a557d

Ohhh Hydroponics *Winky Face*

Starting in 2015, their Urban/Indoor/Hydroponics business has grown from Zero to about 30% of their total revenue. That’s a very good reason to be excited about this business.

Scotts is The Leader in both home/garden and hydroponics. They own all the top brands in a 150 year old, stable, boring, durable business. AND they’ve bought up all the top brands in new, legal-ish, booming side industry. I’m no expert on cannabis, but if you google ‘Legal cannabis sales in US’ the plot is up and too the right. At the right price, this combo of old and steady with new and growing could be a good investment.

So what is SMG worth?

According to QuickFS

10 year Avg ROIC = 12.3%

10 year Rev CAGR = 5.8%

10 year FCF CAGR = 12.8%

10 year EPS CAGR = 13.4%

2021 EPS = $8.96, which is an all time high. Of course it’s dangerous to value a company on peak earnings.

The trailing 3 year average EPS = $7.98

Trailing 10 year average EPS = $4.18

It’s hard to separate the impact of covid on the previous few years. Rolling back the clock, the average earnings in 2017, 2018, and 2019 = $4.57

So what will future earnings look like? Hard to say, I wouldn’t expect lower than $4/share, but $8+ isn’t a crazy prediction either. Let’s bank on $6/share. With growth rates and ROIC slightly better than the average company, a 15x PE seems like a good starting point. 15 x 6= $90/share seems like reasonable valuation for this company. And look, the market is trading SMG at 97 today. (I didn’t cheat, I promise). So I suppose the market isn’t so sure SMG can keep pulling down $9 of earning a share every year. They also must not be ready to give SMG any credit for the potential growth in Hawthorne.

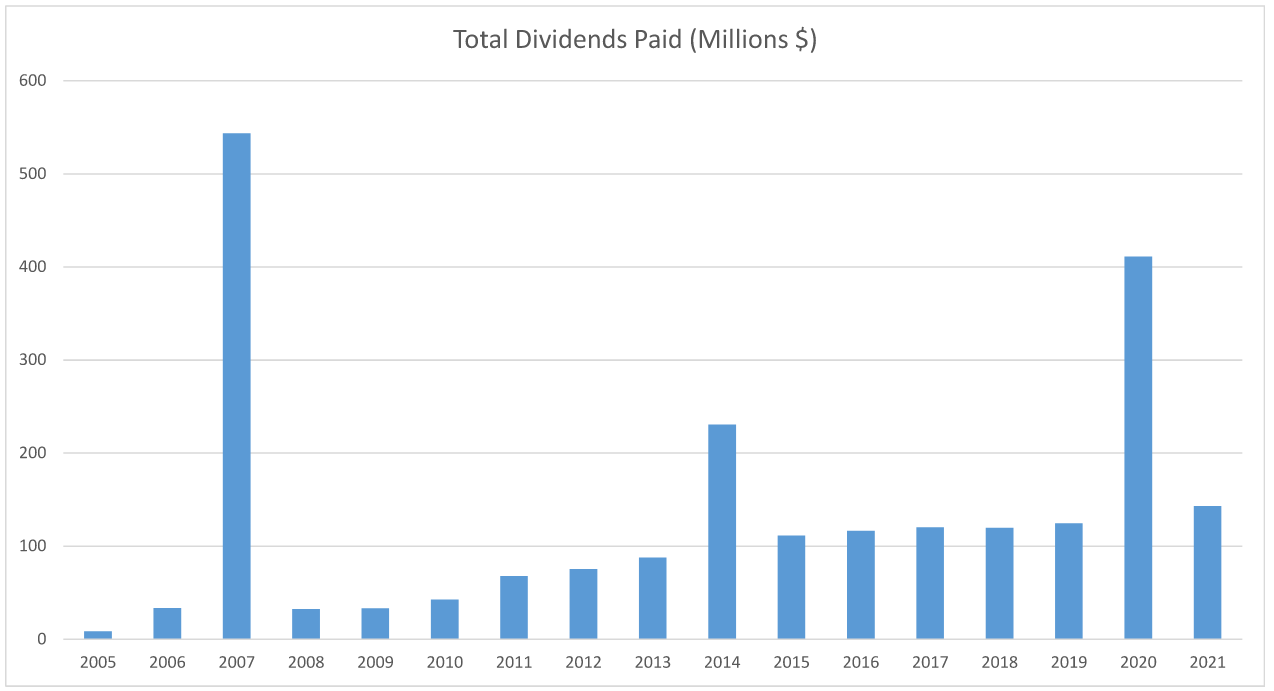

Dividends

The Scotts Miracle-Gro Company began paying dividends in 2005. On July 29, 2020, the Company announced that its Board of Directors had increased the quarterly cash dividend to $0.62 per share, which was first paid to shareholders in the fourth quarter of fiscal 2020. On July 30, 2021, the Company announced that its Board of Directors had increased the quarterly cash dividend to $0.66 per share, which was first paid to shareholders in the fourth quarter of fiscal 2021.

https://scottsmiraclegro.gcs-web.com/static-files/23bfa654-67d3-4f38-bbca-245caa6a557d

The current dividend is sitting at $2.64/share annually, which is about 2.7%. The 1- year dividend growth rate is 8%. Nothing wrong with that. This is a mature business, they make more money than they can reinvest, so they return some of it to the shareholders. But the best part is, they occasionally pay out large special dividends. That’s great if you happened to own the shares when those fat divvy’s were announced, but it’s great for us potential future investors as well because it tells us the executives are Smart Capital Allocators. Special dividends are a pretty basic indicator for that kind of conclusion, but it’s real! They aren’t just on some dividend growth treadmill. It would appear they could afford to pay out larger regular dividends, but they’d rather not tie their hands. I love it.

On July 27, 2020, the Scotts Miracle-Gro Board of Directors approved a special cash dividend of $5.00 per Common Share, which was paid on September 10, 2020 to all shareholders of record at the close of business on August 27, 2020

https://scottsmiraclegro.gcs-web.com/static-files/60536c20-3339-4908-a9b7-7ab9492cfa2c

In the fourth quarter of fiscal 2014, we announced a special one-time cash dividend of $2 per share on the Company's Common Shares

https://scottsmiraclegro.gcs-web.com/static-files/045f49a9-bbff-453c-84f9-4b13d586d34b

In addition, the Company paid a special one-time cash dividend of $8.00 per share on March 5, 2007. The payment of future dividends, if any, on the common shares will be determined by the Board of Directors of Scotts Miracle-Gro in light of conditions then existing, including the Company’s earnings, financial condition and capital requirements, restrictions in financing agreements, business conditions and other factors.

https://scottsmiraclegro.gcs-web.com/static-files/b43614cf-f729-49b5-8164-8cb192235a08

And the special dividends are random amounts! I truly love it. Someone is looking at balance sheet, considering internal investment opportunities, and making a rational decision! That’s so rare. If you asked me to value this company on the dividend alone, I’d be glad to! Starting at $2.64/share, counting on 5% future growth, and discounting those payments back at a 10% hurdle, the dividend alone is worth $52.80.

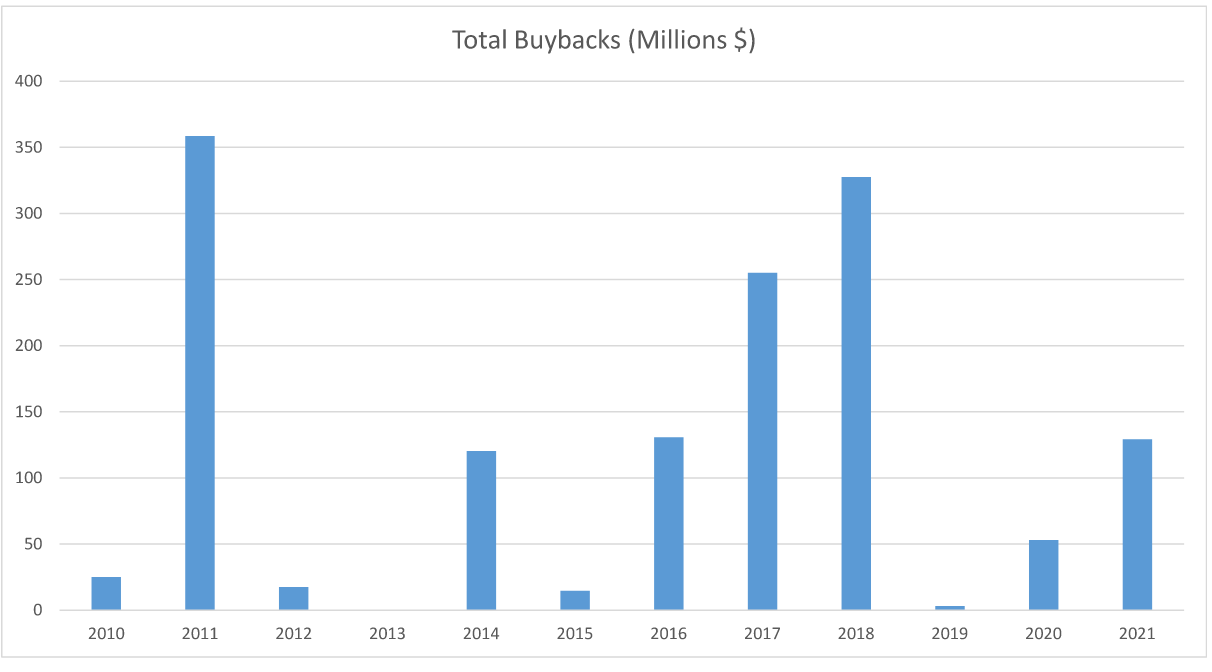

Buybacks

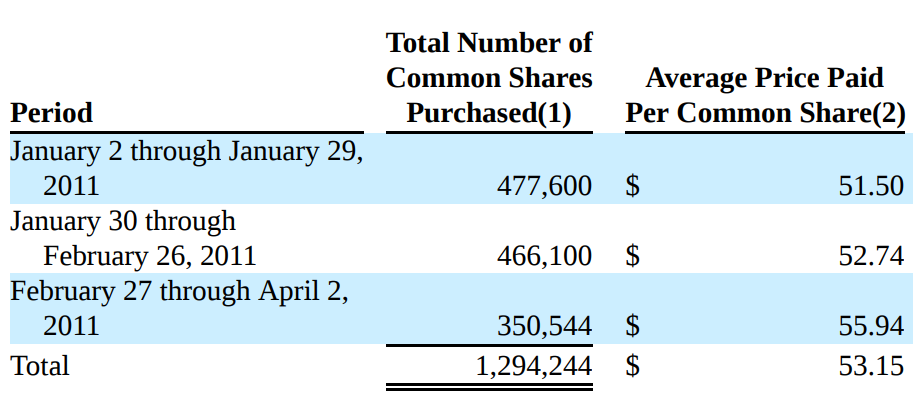

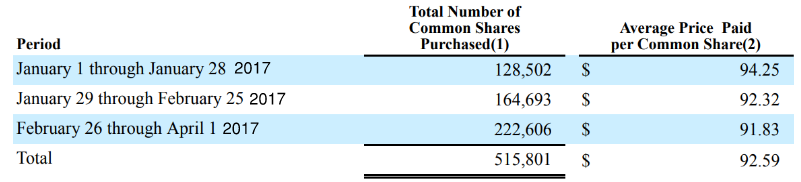

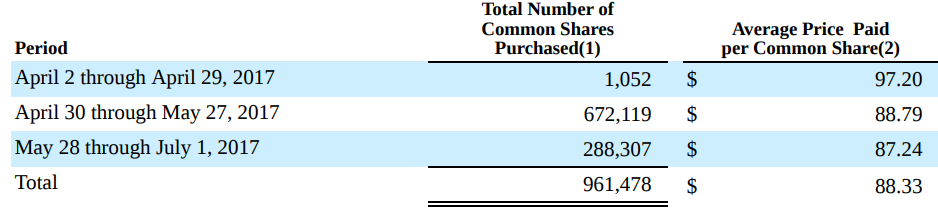

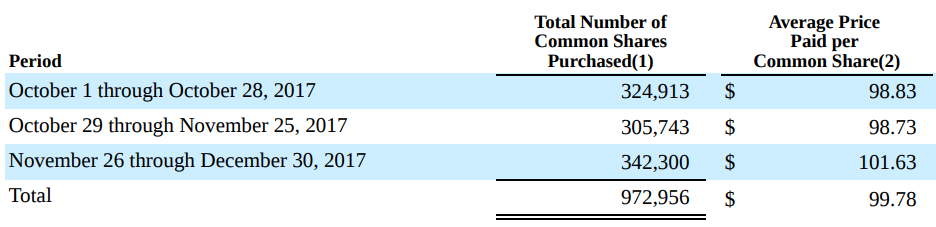

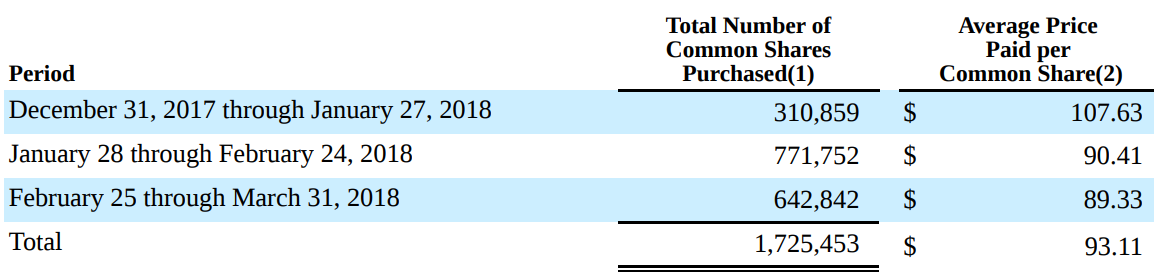

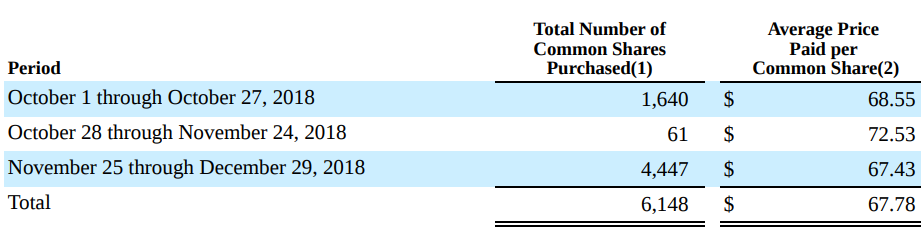

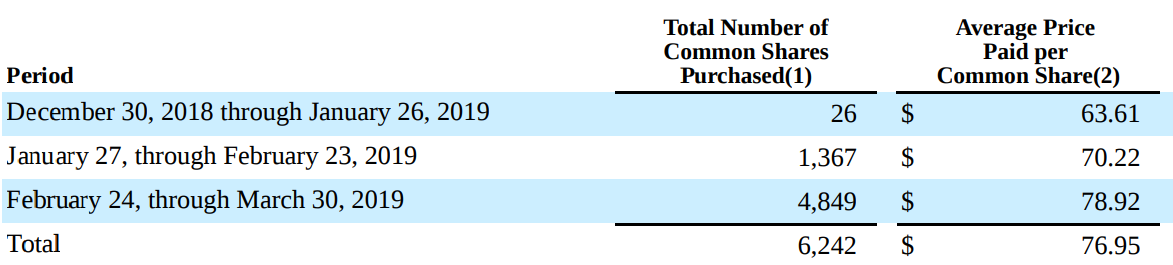

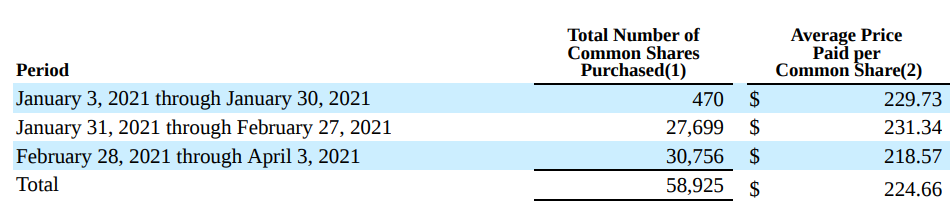

I am obliged to consider dividends, but what really gets me excited are share buybacks! SMG started their buy back program in 2010 and have generally repurchased a few percent of shares outstanding every year, reducing the total amount over that time by 17%. That’s pretty good. But are they considering share price vs intrinsic value? Hard to say. It’s clearly not on auto-pilot, so that’s good. But do they have a sense of intrinsic value… maybe?

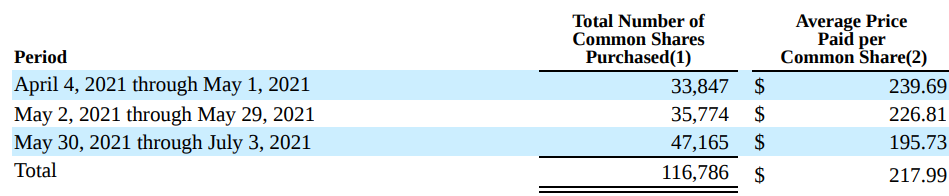

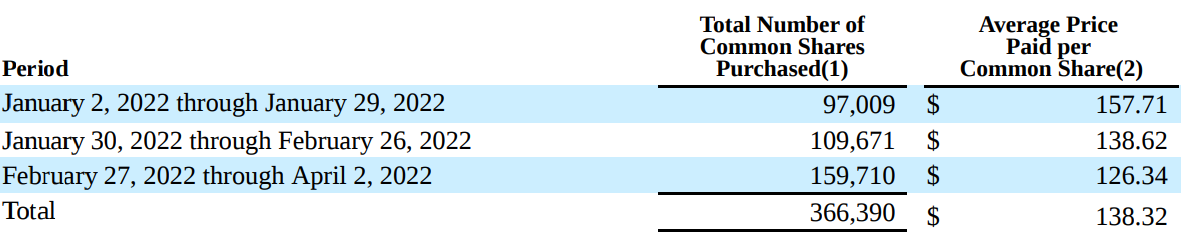

With hindsight, their repurchases look OK except for in 2021.

They bought back quite a bit of stock when it was priced in the 200’s! You can look at that 2 ways:

They are stupid and over paid for those shares. They should have returned that cash through dividends instead.

They are not stupid, they thought that the stock was reasonably priced at $240/share.

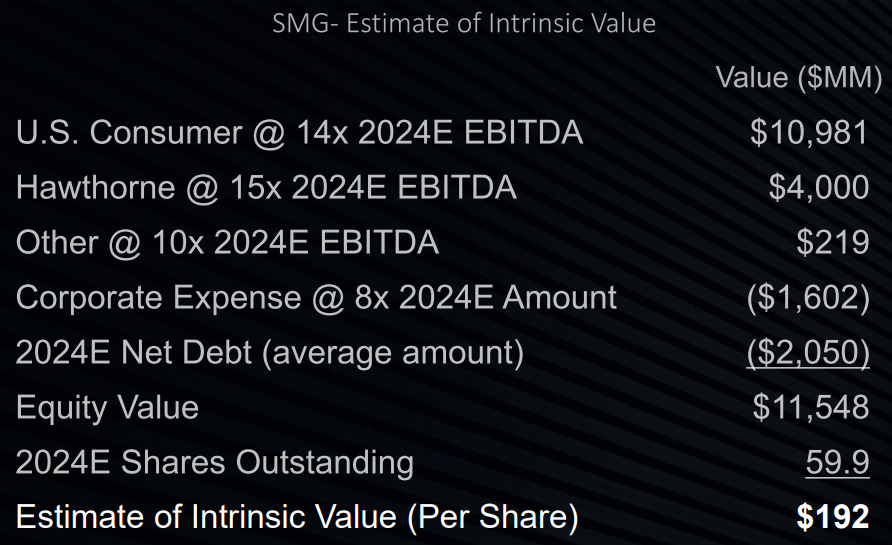

For what it’s worth, the Boyar gang has SMG valued at $192, not too far off from the 2021 peak:

So what is SMG worth…

Always a tricky question. It depends on the story you want to tell. I like this company and their future prospects. I’m thinking the US will keep building homes, and most of those homes will have lawns. I’m thinking the US will gradually legalize MJ and Hawthorne will continuing growing in significance to SMG. And i’m thinking all along the way SMG will be paying out dividends or buying back stock, whichever makes the most sense at the time. I value this stock at $105. (15x7, I talked myself up to trusting $7 EPS). I don’t think I’m smart enough to value them on a multiple of 2024 earnings.

It’s been a volatile few months for Scotts. Today, they trade at $97, but they traded as low as $89 in May. Although the price is not that far below my ‘valuation’, this is a stock I’d like to own and hold for a long time… so I might not need much convincing.

But the same thing is true for Intel! And Intel just seems WAY too cheap. They make $5 per share in earnings every year. In the last quarter, they earned $2 per share already! They are sitting on $32 billion in cash and $32 billion in debt. Who is selling this company for $44/share?!?

SMG or INTC

What an interesting question! I think SMG has more long term upside, but I think INTC is cheaper. It’s a rocky market, and they are each currently putting up peak numbers. So what happens when earnings drop for either company… I could see SMG falling even further, but how could INTC get any cheaper - even if earnings fell 20% this year (which they won’t). So for now, I’m looking to buy Intel. But I like SMG and I might figure out a way to get it in the portfolio also, especially if see’s more selling.